Aseptic Filling Machine Market Size Projected to Attain USD 3.18 Bn by 2034 says Healthcare Specialist

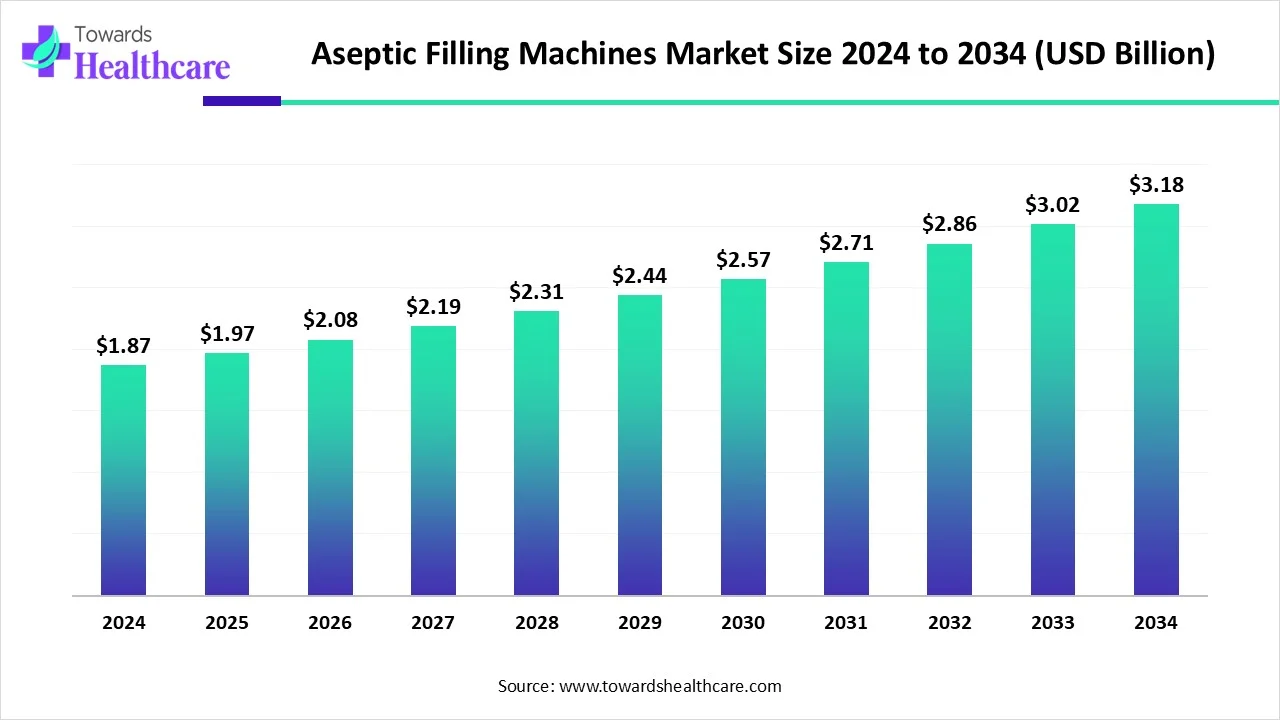

The global aseptic filling machine market size is calculated at USD 1.97 billion in 2025 and is expected to reach around USD 3.18 billion by 2034, growing at a CAGR of 5.45% for the forecasted period.

Ottawa, Aug. 06, 2025 (GLOBE NEWSWIRE) -- The global aseptic filling machine market size was valued at USD 1.87 billion in 2024 and is predicted to hit around USD 3.18 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

The growth of the market is driven by the increasing demand for packaged food and beverages, stringent regulatory standards, and technological advancements.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5699

Key Takeaways

- Asia Pacific is dominant in the aseptic filling machine market share in 2024.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By type, the stand-alone filling machine segment for the largest market revenue in 2024.

- By type, the tabletop filling machine segment is expected to register the fastest CAGR over the forecast period.

- By mode of operation, the fully automatic segment accounted for the largest market revenue in 2024.

- By mode of operation, the semi-automatic segment is expected to register significant growth over the forecast period.

- By end user, the food and beverages segment accounted for the largest aseptic filling machine market revenue in 2024.

- By end user, the pharmaceutical segment is expected to register the fastest CAGR over the forecast period.

Market Overview & Potential

Aseptic filling machine is a specialised equipment which is extensively used in various industries like pharmaceutical and food, and beverages, which offers a sterile environment for product filling, like in pharmaceutical dosages, maintaining sterility, and maintaining the safety of the product. The key factors also make it ideal for use by many industries, like sterile environment, sterilization, and maintenance of safety for most of the food and beverage products, precision filling, versatility, and product integrity maintenance.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2025 | USD 1.97 Billion | |

| Projected Market Size in 2034 | USD 3.18 Billion | |

| CAGR | 5.45% | |

| Leading Region | North America | |

| Market Segmentation | By Type, By Mode of Operations, By End User, By Region | |

| Top Key Players | ALFA LAVAL, GEA Aseptic Filling, Dara Pharma, Saini Industries, John Bean Technologies Corp, Groninger Holding Gmbh & Co. KG., Syntegon Technology Gmbh, Bauschstrbel SE Co. KG., Serac Group, Knones AG | |

What is the Growth Potential Responsible for the Growth of the Aseptic Filling Machine Market?

The growth of the market is driven by the growing demand from various industries, especially for extending shelf life, convenience, health trends, and processed food consumption to maintain sterility, which fuels the growth of the market. The stringent regulatory standards for food and pharmaceutical safety, which increase the demand and need for highly sterile and reliable filing processes for medications and also in food to ensure product safety and to meet the regulatory standards, drive the growth of the market. The growing pharmaceutical industry especially in biologics and vaccines, and in pharmaceutical dosage, further boosts the growth of the market.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Are the Growing Trends Associated with the Aseptic Filling Machine Market?

Rising demand for sterile packaging:

- The growing demand for sterile packaging to enhance and improve shelf life increases the demand for the market and supports growth.

Technological advancements:

- The technological advancements like automation, and integration of AI and IoT for real-time monitoring, for increasing efficiency and precision, boost the growth.

Stringent regulations:

- Regulation for regulatory standards and compliance for product safety and manufacturing processes increases the growth of the market.

Expansion of pharmaceutical and food & beverage industries:

- The growing industries and demand for product safety and demand for aseptic filling machines from industries boost the growth of the market.

What Is the Growing Challenge in the Aseptic Filling Machine Market?

The aseptic filling machine market faces various challenges, like high initial investments as it requires advanced technology and sterilization capabilities, which require high cost but less accessibility and limited availability limit the growth of the market. The high maintenance cost and supply chain issues of high-grade stainless steel and electronic parts impact the production which resulting in increased costs, which hinders the growth and expansion of the market.

Regional Analysis

How Did Asia Pacific Lead the Aseptic Filling Machine Market in 2024?

Asia Pacific led the aseptic filling machines market, with rapid population growth and expected substantial economic expansion bolstering its role as a global food producer. Rising urbanization also elevates demand for long-shelf-life and ready-to-eat foods and beverages, thereby increasing the need for aseptic filling technology. The biopharmaceutical sector in the APAC region is expanding swiftly, fueled by strong government backing, international collaborations, and regulatory reforms.

Aseptic technology is critical for manufacturing injectables, vaccines, and sterile medicines, supporting market growth. Additionally, biopharma companies are attracting significant investment from both domestic and international sources, backed by government policies that promote innovation and funding. This fosters research and development, leading to new therapies and technologies, including aseptic filling lines. The availability of utilities such as electricity, water, steam, land, and environmental compliance further propels the market.

China sees a major surge in aseptic filling machine use, fueled by its booming beverage and dairy markets. With a growing middle class seeking high-quality, preservative-free products, manufacturers prioritize sterile production. Government support for food safety and domestic technological advances further accelerates adoption in both the food and pharmaceutical sectors.

In India, rising consumer awareness of hygiene and shelf-stable products is boosting the use of aseptic filling machines. The growing packaged food and pharmaceutical industries demand efficient, contamination-free processes. Urbanization and changing lifestyles increase demand for ready-to-consume items, encouraging both local and multinational firms to invest in this technology.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What Factors Contributed to North America's Notable Growth in the Aseptic Filling Machine Market in 2024?

North America is expected to see the quickest growth in the aseptic filling machine sector during this period. Increasing demand for functional beverages and foods, driven by socioeconomic shifts towards greater health consciousness, is fueling the need for aseptic filling. The biotech and pharmaceutical industries are undergoing significant transformation, propelled by digital innovations, advancements, and strategic partnerships.

Aseptic filling is essential for ensuring sterility in these high-value products. The U.S. Food and Drug Administration (FDA) regulates the safety, quality, and effectiveness of vaccines, requiring sterile, preservative-free packaging, which makes aseptic filling indispensable. The launch of new brand-name drugs has increased pharmaceutical spending, replacing older, less expensive treatments or addressing previously untreatable conditions, thereby boosting demand for aseptic filling machines.

In the U.S., the aseptic filling machine market is growing rapidly, driven by demand for extended shelf-life beverages, pharmaceuticals, and dairy products. The food and biotech industries increasingly prefer aseptic technology to reduce preservatives and maintain product quality. Advancements in automation and sustainability also contribute to their expanding adoption across sectors.

Canada's aseptic filling market is expanding due to increased demand for safe, long-lasting food and beverage products. Stringent food safety regulations encourage industries to adopt aseptic processes. The rise in functional drinks, ready-to-eat meals, and pharmaceutical innovations is prompting more manufacturers to invest in advanced, sterile medical packaging technologies.

- According to Volza's Global Export data, the World shipped out 13,976 Aseptic Packaging Material shipments from November 2023 to October 2024 (TTM). These exports were handled by 333 global exporters to 694 buyers, showing a growth rate of 146% over the previous 12 months.

- Globally, India, China, and Thailand are the top three exporters of Aseptic Packaging Material. India is the global leader in Aseptic Packaging Material exports with 27,567 shipments, followed closely by China with 8,727 shipments, and Thailand in third place with 6,727 shipments.

Segmental Insights

By type

The stand-alone filling machine segment for the largest aseptic filling machine market revenue in 2024. A standalone filling machine is designed for filling a wide variety of products. These machines come with various accessories such as vacuum filling, hot filling, and inert atmosphere systems in the tank. They are suitable for those seeking a medium-capacity filling solution in cylinder filling plants, offering flexible capacity and compatibility with different equipment. These factors make it a preferred choice by the manufacturers and also by various industries, which drives the growth of the market.

The tabletop filling machine segment is expected to register the fastest CAGR over the forecast period. Typically, this system is used in scenarios where the operator physically places bottles onto the machine. The bottle support system, attached to the machine, is adjustable to accommodate different bottle diameters easily. The tabletop filling machine offers benefits like precise filling combined with user-friendly operation. These benefits and key factors increase the demand for the market, contributing to the growth and expansion of the market.

By mode of operation

The fully automatic segment accounted for the largest aseptic filling machine market revenue in 2024. It ensures a reliable, repeatable, and consistent filling cycle, whether based on product level, weight, volume, or other measurements. Automatic fillers help eliminate inconsistencies and uncertainties in the filling process. Automation enhances packaging efficiency in various ways, providing numerous benefits to packaging organizations.

The semi-automatic segment is expected to register significant growth over the forecast period. Since the semi-automatic filling machine is simple to control, usually operated via a foot switch or manual button, it is easy for employees to operate and reduces complexity. It is versatile, suitable for various liquids, and adaptable to meet different packaging needs. Compared to fully automatic machines, semi-automatic fillers are more affordable and have lower equipment investment costs.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

By end user

The food and beverages segment accounted for the largest aseptic filling machine market revenue in 2024. They help maintain product freshness and quality, extend shelf life, and ensure food safety by preventing contamination. Aseptic filling supports easier transportation and storage, making it an economical and sustainable packaging choice for food and beverage producers. Investing in aseptic technology allows companies to meet consumer demands for high-quality products while reducing waste and lowering their carbon footprint.

The pharmaceutical segment is expected to register the fastest CAGR over the forecast period. Aseptic filling machines significantly reduce contamination risks in pharmaceutical production, improving product quality and extending shelf life. They minimize bacterial growth and spoilage, helping manufacturers preserve product integrity and deliver superior quality to customers. By ensuring a sterile filling process, these machines prevent microbial growth, maintaining taste and quality over time. Additionally, aseptic fillers improve efficiency by enabling continuous production with minimal downtime for sterilization and cleaning.

Recent Developments in the Aseptic Filling Machine Market

- In November 2024, SIG, a leading provider of packaging solutions, is expanding its SIG Neo filling machine range, introducing the world’s fastest and most flexible aseptic carton filler for multi-serve formats. The new SIG Neo Slimline 15 Aseptic was unveiled at Gulfood Manufacturing in Dubai, showcasing a machine capable of filling up to 15,000 SIG SlimlineBloc packs per hour, boosting output by 25% compared to typical machines for family-sized formats.

- In April 2024, Additionally, SIG has introduced a new system for pre-made, spouted aseptic pouches designed for in-line sterilization, streamlining the supply chain and reducing production costs. The SIG Prime 55 In-Line Aseptic eliminates the need for third-party pre-sterilization of spouted pouches. It has been brought to market and was a key topic at the 2024 Anuga FoodTec exhibition in Cologne, Germany.

Top Companies and Their Contributions to the Market

| Company | Contributions & Offerings |

| ALFA LAVAL | Offers advanced aseptic processing solutions with high hygiene standards. Known for sustainable and energy-efficient systems ideal for food, dairy, and pharma. |

| GEA Aseptic Filling | Delivers highly flexible aseptic filling systems, especially for beverages. Focuses on modularity, hygiene, and cutting-edge sterilization technology. |

| Dara Pharma | Specializes in aseptic filling for pharma and biotech industries. Offers compact, scalable machines suitable for vials, syringes, and cartridges. |

| Saini Industries | An Indian manufacturer providing cost-effective, robust aseptic filling systems. Focuses on the pharmaceutical and cosmetic sectors with customization options. |

| John Bean Technologies Corp | Supplies innovative aseptic liquid food processing and filling equipment. Known for automation, efficiency, and food safety excellence. |

| Groninger Holding GmbH & Co. KG | Offers high-precision aseptic and sterile filling systems for cosmetics and pharmaceuticals. Focuses on innovation and quality assurance. |

| Syntegon Technology GmbH | Provides end-to-end aseptic packaging solutions. Strong presence in pharmaceutical applications, emphasizing safety and cleanroom standards. |

| Bausch+Ströbel SE + Co. KG | Designs and builds aseptic filling and packaging machines for pharmaceuticals. Known for flexibility, precision, and reliability. |

| Serac Group | Develops aseptic filling solutions for dairy and beverages. Emphasizes hygiene, productivity, and reduced environmental impact. |

| Krones AG | Offers state-of-the-art aseptic filling lines with advanced sterilization and automation. Strong in beverage and liquid food markets globally. |

Browse More Global Trends in Aseptic Processing, Sampling, and Healthcare Technologies

The global automatic aseptic sampling market is valued at USD 150 million in 2024, increasing to USD 179.01 million in 2025, and is projected to reach approximately USD 884.54 million by 2034, expanding at a robust CAGR of 19.34% from 2025 to 2034.

The global aseptic fill finish market is estimated at USD 6.04 billion in 2024, growing to USD 6.71 billion in 2025, and forecasted to reach USD 17.17 billion by 2034, driven by a CAGR of 11.04% over the forecast period.

The CDMO aseptic filling solutions market continues to gain momentum, fueled by the increasing demand for sterile manufacturing practices and the rising prevalence of complex injectable therapies.

In parallel, the global aseptic fill finish manufacturing market is valued at USD 5.94 billion in 2024, expected to grow to USD 6.47 billion in 2025, and projected to hit USD 14.01 billion by 2034, marking a steady CAGR of 8.94% between 2025 and 2034.

The global aseptic sampling market stood at USD 0.95 billion in 2023 and is expected to reach approximately USD 2.31 billion by 2034, registering a CAGR of 7.76% from 2024 to 2034, driven by stringent quality control measures in bioprocessing.

The medical thromboelastography machine market was valued at USD 390 million in 2023 and is projected to reach USD 1,020.68 million by 2034, with a CAGR of 9.14%, fueled by growing demand for point-of-care coagulation testing

Meanwhile, the machine learning in drug discovery market is undergoing rapid transformation, with revenues expected to surge into the several hundred million dollar range by 2034, supported by breakthroughs in AI-driven pharmaceutical research.

The global obstetrical devices market is valued at USD 8.52 billion in 2024, set to rise to USD 8.83 billion in 2025, and expected to reach USD 12.18 billion by 2034, expanding at a CAGR of 3.64%.

The blood plasma freezer market was valued at USD 542 million in 2023 and is anticipated to grow to USD 903.01 million by 2034, at a steady CAGR of 4.75%, driven by increased demand for blood component preservation.

Lastly, the PFAS testing market is forecasted to grow from USD 469.61 million in 2024 to USD 537.9 million in 2025, reaching approximately USD 1,825.21 million by 2034, showcasing an impressive CAGR of 14.54% over the forecast period, spurred by regulatory pressure and environmental health concerns.

Aseptic Filling Machine Market Key Players List

- ALFA LAVAL

- GEA Aseptic Filling

- Dara Pharma

- Saini Industries

- John Bean Technologies Corp

- Groninger Holding Gmbh & Co. KG,

- Syntegon Technology GmbH

- Bauschstrbel SE Co. KG.

- Serac Group

- Knones AG

Segments Covered in The Report

By Type

- Tabletop Filling Machine

- Stand-Alone Filling Machine

By Mode of Operations

- Semi-Automatic

- Fully Automatic

By End User

- Food and Beverages

- Pharmaceuticaa

- Cosmetics

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Gain full access to expert analysis, growth drivers, and strategic recommendations for market success: https://www.towardshealthcare.com/price/5699

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.