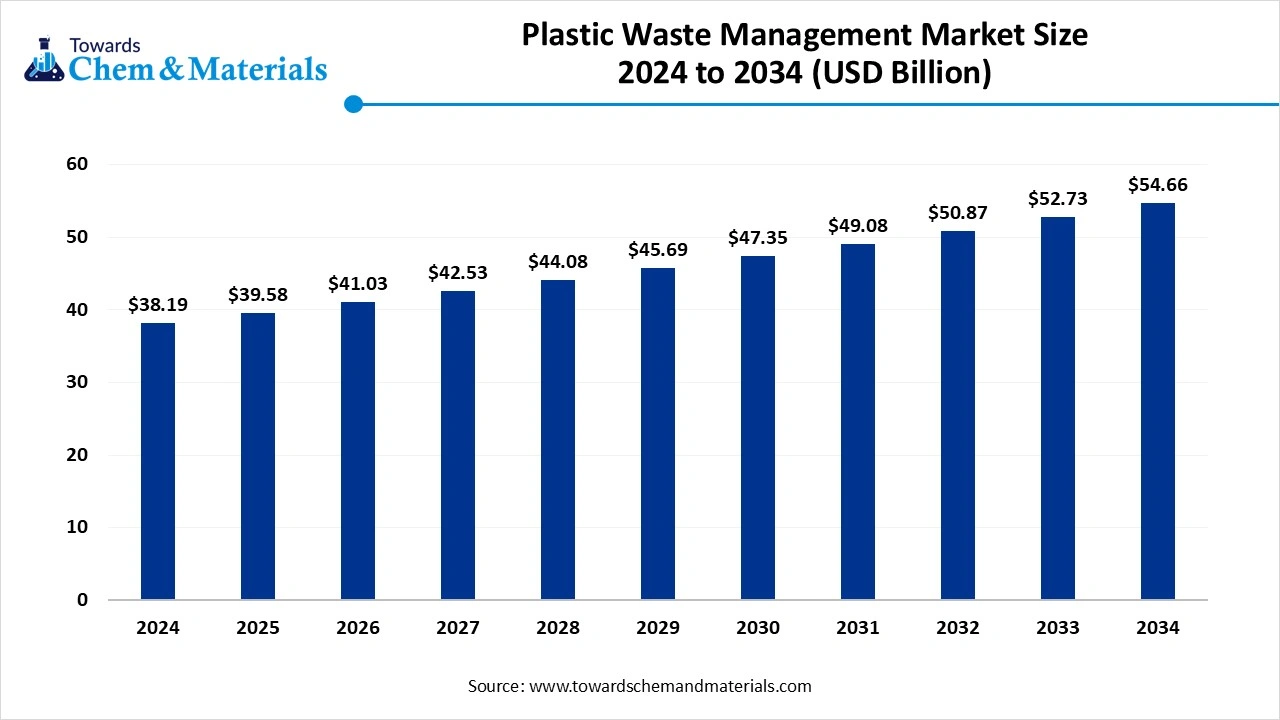

Plastic Waste Management Market Size to Surpass USD 54.66 Bn by 2034

According to Towards Chemical and Materials, the global plastic waste management market size is calculated at USD 39.58 billion in 2025 and is expected to surpass around USD 54.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period 2025 to 2034.

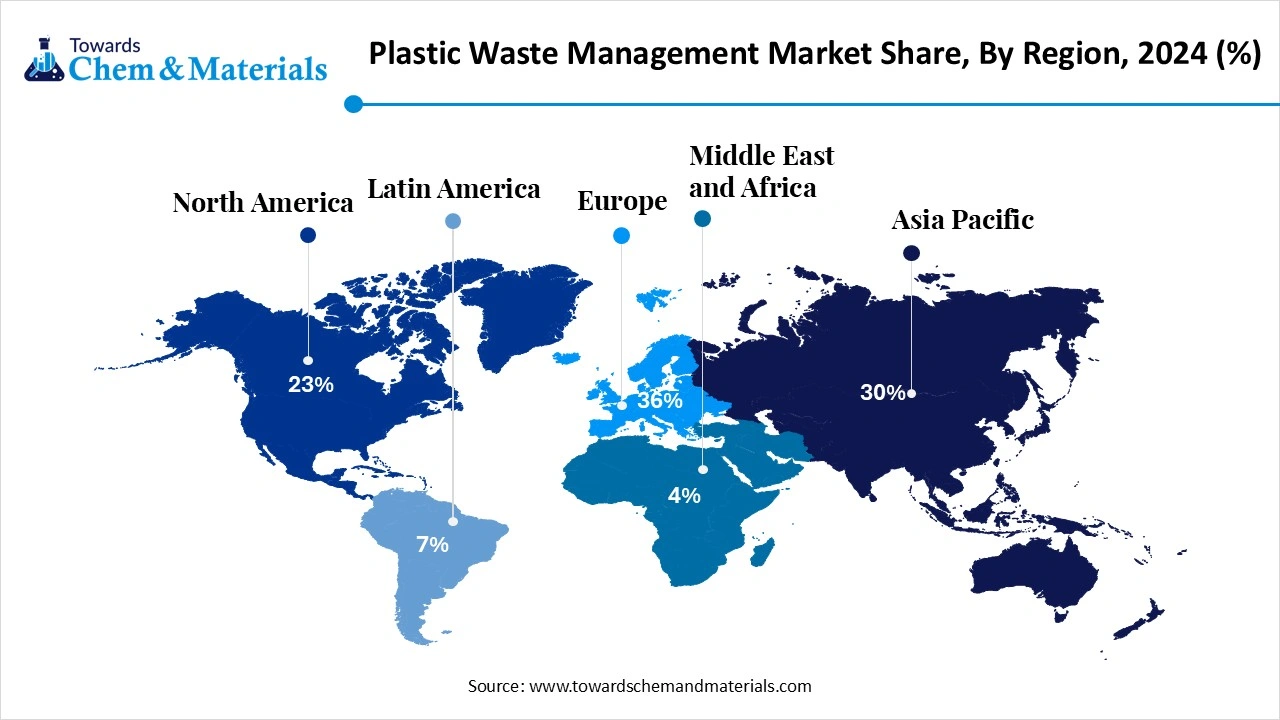

Ottawa, Oct. 29, 2025 (GLOBE NEWSWIRE) -- The global plastic waste management market size was valued at USD 38.19 billion in 2024 and is anticipated to reach around USD 54.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period from 2025 to 2034. Europe dominated the Plastic Waste Management market with a market share of 36% in 2024. Increasing government regulations and initiatives promoting plastic recycling and sustainability are driving the growth of the market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5925

Plastic Waste Management Overview

The global plastic waste management market is experience steady growth driven by heightened environmental awareness, increasing plastic consumption, and the proliferation of stringent government regulations aimed at minimizing waste and promoting circular economy practices. This market features a wide range of activities spanning the collection, transportation, sorting, treatment and disposal of plastic waste across various polymer types, sources and end use industries. Developments in advanced of bio-based and biodegradable plastics are driving innovation and investment, particularly in regions with strong recycling infrastructure and regulatory frameworks. Regions such as Europe continue to hold a significant share of the market, while areas like Asia Pacific are poised for rapid expansion owing to urbanization, industrial growth, and rising plastic waste generation. On the service side, collection and transportation remain foundational, but recycling services are gaining traction.

Plastic Waste Management Market Report Highlights

- The Europe plastic waste management market held the largest share of 36% of the global market in 2024.

- By service type, the collection & transportation segment held the highest market share of 36% in 2024.

- By treatment method, the mechanical recycling segment held the highest market share of 43% in 2024.

- By polymer type, the polyethylene segment held the largest revenue share of 39% in 2024.

- By source, the residential segment held the largest market share of 45% in 2024.

- By sorting technology, the optical / NIR-based segment held the highest market share of 41% in 2024.

- By end use, the packaging & bottles segment held the largest market share of 49% in 2024.

Benefits of Plastic Waste Management?

Plastic waste management offers several important benefits for both the environment and society:

- Environmental Protection: Proper plastic waste management helps reduce pollution by preventing plastic from entering landfills, oceans, and other ecosystems. This prevents harm to wildlife, marine life, and plant species that can ingest or become entangled in plastic.

- Conservation of Resources: Recycling plastic waste reduces the need for new raw materials, saving energy, water, and other natural resources. This helps conserve resources for future generations and supports a circular economy.

- Reduction of Greenhouse Gas Emissions: By recycling plastics, less energy is used compared to manufacturing new plastic products, which helps lower carbon emissions and mitigate climate change.

- Improved Public Health: Proper disposal and recycling of plastic waste can reduce exposure to toxic substances that are released when plastics degrade in uncontrolled environments, thus improving public health outcomes.

- Job Creation and Economic Growth: The recycling and plastic waste management industries create jobs in collection, sorting, recycling, and manufacturing. This supports local economies and can lead to sustainable economic growth.

- Reduction of Landfill Space: By recycling plastic, we can divert waste away from landfills, which helps conserve space and extend the lifespan of existing landfills.

- Support for Sustainable Innovation: Plastic waste management encourages the development of innovative solutions such as biodegradable plastics, improved recycling technologies, and more sustainable packaging alternatives.

- Enhanced Brand Image and Corporate Responsibility: Companies that engage in responsible plastic waste management can improve their reputation and appeal to environmentally conscious consumers.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5925

Plastic Waste Management Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 42.03 billion |

| Revenue forecast in 2034 | USD 54.66 billion |

| Growth Rate | CAGR of 3.65% from 2025 to 2034 |

| Base year for estimation | 2025 |

| Historical data | 2021 - 2025 |

| Forecast period | 2025 - 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Service Type, By Treatment Method, By Polymer Type, By Source, By Sorting Technology, By End Use of Recovered Plastics, By Region |

| Key companies profiled | Veolia Environments S.A.; SUEZ Environments Company; Waste Management, Inc.; Republic Services Inc.; Waste Connections Inc; Clean Harbors, Inc.; Biffa PLC; Covanta Holding Corporation; Stericycle Inc.; Remondis SE & Co. KG; ADS Waste Holdings, Inc.; Hawkvale Limited; Hahn Plastics Limited; Progressive Waste Solutions Ltd.; United Plastic Recycling, Inc. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Plastic Waste Management Market Concentration & Characteristics

The market growth stage of plastic waste management is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of competition owing to the various cost-efficient technologies adopted by the market players to improve their plastic waste management capability. Further, emerging economies witnessed a rapid growth in investment in plastic recycling infrastructure, thereby driving the competition between the market players.

The market is also characterized by a high degree of new service launches, which results in the development of plastic waste management. For instance, the 500-tonne-per-year showcase plant in Monthey, Switzerland, was introduced in April 2025 by the DePoly sustainable PET-to-raw-material recycling firm. At this facility, waste PET and polyester will be transformed into virgin-grade raw materials without the use of fossil fuels. Such new service launches can lead to increased market penetration for a market player by entering into new segments and expanding its customer base.

The market is moderately fragmented, dominated by few major players, including Veolia Environment S.A., Republic Services Inc., and Biffa PLC. However, some smaller companies are also competing in space at the country/regional level. The key players' strategies most often involve acquisitions and regional expansion.

Regulations such as the Plastic Bags Directive in Europe and the Resource Conservation and Recovery Act (RCRA) in the U.S. significantly impact the plastic waste management market. In addition, environmental requirements such as recycling targets and landfill diversion mandates incentivize businesses and local governments to invest in recycling infrastructure. All such factors are encouraging more companies to participate in the overall plastic waste management industry.

Here Are Some Of The Top Products In The Plastic Waste Management Market

Polyethylene Terephthalate (PET) Recycling Systems

- PET is one of the most recycled plastics, with a global recycling rate of approximately 29%.

- Recycled PET is used in various applications, including bottles, textiles, and packaging.

Polypropylene (PP) Recycling Solutions

- PP is experiencing the fastest growth in recycling, with a projected CAGR of over 5.2% from 2024 to 2032.

- Recycled PP is utilized in packaging, automotive components, and consumer goods.

Chemical Recycling Technologies

- Companies like Agilyx and Braskem are developing chemical recycling solutions to convert difficult-to-recycle plastics into valuable feedstocks.

- These technologies enable the recycling of mixed and contaminated plastics, enhancing overall recycling rates.

AI-Powered Sorting Systems

- AI and deep learning technologies are being employed to improve the accuracy and efficiency of plastic waste sorting.

- Systems like ConvoWaste and AMP Robotics automate waste segregation, reducing contamination and increasing recycling rates.

Bioplastics from Organic Waste

- Innovations like MarinaTex, a bioplastic made from red algae and fish waste, offer biodegradable alternatives to traditional plastics.

- These materials decompose within four to six weeks in compostable environments, reducing plastic pollution.

Waste-to-Energy Systems

- Technologies that convert plastic waste into renewable energy, such as fuel or electricity, are being developed to address both waste disposal and energy generation needs.

- For example, a facility in South Korea converts over 80% of plastic waste into electricity.

Recyclable Packaging Resins

- Companies like Dow have introduced recyclable packaging resins, such as INNATE TF 220, to enhance the recyclability and performance of flexible plastic packaging.

- These resins support the circular economy by enabling the recycling of packaging materials.

Recycled Plastic Products in Fashion

- Startups like Samsara Eco are developing enzymes to break down nylon 6, enabling indefinite recycling and reducing waste in the fashion industry.

- Collaborations with brands like Lululemon aim to promote circular economy practices in fashion.

Plastic Waste Collection Initiatives

- Programs like Tata Power's Anokha Dhaaga Smart Circularity programme have converted thousands of kilograms of single-use plastic waste into recycled fabric products.

- These initiatives also support community livelihoods by providing fair-trade earnings.

Recycled Plastic Building Materials

- Innovations in architecture are exploring the use of recycled plastics in construction, such as vacuum-sealed chainmail structures made from recycled plastic filaments.

- These materials offer lightweight, adaptable, and durable properties for architectural use.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5925

What Are The Major Trends In The Plastic Waste Management Market?

- The shift towards circular economy models is driving increased investment in recycling infrastructure and partnerships across the value chain.

- Advanced recycling technologies (including chemical recycling, depolymerisation, and pyrolysis) are gaining traction as means to handle hard to recycle plastics and improve quality of recylates.

- Digitalisation of sorting and tracking use of AI, robotics, optical/NIR systems and reduce plastic waste leakage.

- Growing regulatory pressure and extended producer responsibility frameworks are pushing companies to adopt sustainable packaging, increasing recycled content and reduce plastic waste leakage.

- Rising demand for bio-based or biodegradable plastic and design for-recycling products is influencing manufacturers to rethink material choices to improve end of life outcomes.

How Does AI Influence The Growth Of The Plastic Waste Management Market In 2025?

Several factors are set to influence growth in the plastic waste management market in 2025. Growing public and corporate awareness of plastic pollution is encouraging investment in recycling and waste management solutions, while sweeping regulatory shifts such as bands on single use plastics and mandates for recycled content in packaging are compelling manufacturers and service providers to overhaul their operations. Meanwhile, technological innovation in sorting, processing and chemical recycling is enhancing he efficiency and viability of waste treatment systems. Rapid urbanization and rising consumption of plastics in emerging economies are increasing the volume of waste requiring management, and at the same time enterprises are adopting circular economy business models and sustainability strategies.

Plastic Waste Management Market Dynamics

Growth Factors

Can Advanced Recycling Tech Turn Waste Into Value?

A wave of breakthroughs in recycling technologies such as enzyme and catalyst driven processes that break down familiar plastics into reusable molecules are transforming plastic from waste to feedstock and opening new business models for circularity. These innovations are drawing investment, driving equipment upgrades, and enabling treatment of previously hard to recycle plastics, thereby expanding the scope and profitability of waste management operations.

Will Stringer Plastic Supply Chain Accountability Boost Collection And Reuse?

Growing pressure on corporations and brands to account for plastic throughout its lifecycle backed by sourcing initiatives, traceability programs and waste credit standards means more waste is being captured, sorted and processed rather than lost to landfill or leakage. This shift is encouraging collaboration between informal waste workers, formal recyclers and global brands, enhancing the logistics, infrastructures and value flows in plastic waste management and elevating the market’s overall momentum.

Market Opportunity

Could Informal Sector Integration Unlock New Value Streams?

In many regions the informal waste collection sector plays a major role in gathering plastics that never reach formal recycling systems, and by integrating these workers into organised collection and processing chains one can unlock both environmental value and social impact while opening new businesses models in recycling. Formalising these operations also enhances traceability, quality of feedstock and investor confidence, which creates an opportunity for companies to build value added services in previously underserved geographies.

Limitations In The Plastic Waste Management Market

- A major limitation in the market is the lack of adequate collection and recycling infrastructure, specially in many developing regions, which hampers effective treatment and diversion of plastic waste.

- Another significant barrier is the high operational and capital costs associated with advanced recycling technologies, which reduce profitability and slow adoption across the industry.

Plastic Waste Management Market Segmentation Insights

Service Type Insights

Why Did The Collection And Transportation Segment Dominated The Plastic Waste Management Market In 2024?

The collection and transportation segment dominated the market in 2024. The collection and transportation segment continues to form the foundation of plastic waste management services, as it involves the gathering and conveyance of waste plastics from households and other sources to processing or disposal facilities. Because efficient collection and transport are vital for enabling subsequent recycling, sorting and treatment steps, this segment maintains stable demand and importance across geographies. Infrastructure investments, public private partnerships and municipal waste management reforms all underline why this service remains central to the market’s overall structures.

The chemical recycling segment is projected to experience the highest growth rate in the market between 2025 and 2034. The chemical recycling segment is gaining momentum because it offers potential to handle more complex plastic waste streams and convert them back into monomers or valuable feedstocks, thereby aligning with circular economy goals. As regulatory pressure mounts and the need for higher value recycling increases, chemical recycling services are becoming attractive for waste management firms, technology providers and investors. This means the service type landscape is shifting, with chemical recycling expected to capture rising focus and investment moving forward.

Treatment Method Insights

Why Did The Mechanical Recycling Segment Dominated The Plastic Waste Management Market In 2024?

The mechanical recycling segment dominated the market in 2024. Mechanical recycling remains the workhorse of plastic waste treatment, it involves sorting, cleaning, shredding and re-melting plastics to produce recycled materials for reuse. This method is widely deployed, supported by well-established infrastructure and recognised technology, which helps expain its dominant position. It also benefits from relatively lower complexity and established end markets that accept mechanically recycled material, making it a reliable treatment route today.

The chemical recycling segment is set too experience the fastest rate of market growth from 2025 to 2034. The chemical recycling method is evolving rapidly thanks to technological advances in depolymerisation, pyrolysis and solvent based processes, which enable treatment of plastics that cannot easily be mechanically recycled. As industry and policy aim for higher circuitry, chemical recycling treatment is drawing increasing attention and investment. Over the forecast period, these factors suggest that chemical recycling will become a leading treatment methods in terms of growth.

Polymer Type Insights

Why Did The Polyethylene Segment Dominated The Plastic Waste Management Market In 2024?

The polyethylene segment dominated the market in 2024. Polyethylene (PE) including both high density and low density grades remains the most prevalent polymer in plastic waste streams, owing to its widespread use in packaging, films, containers and other everyday applications. Its dominance in waste qualities makes it a central focus for waste management efforts, recycling programmes and value chain developments.

The polypropylene segment is projected to expand rapidly in the market in the coming years. Polypropylene (PP) is increasingly used in applications such as the circular economy agenda intensifies, PP waste streams are gaining more recycling attention. Improvements in sorting, compatibilisation and processing of mixed PP waste are supporting its growth potential, making it one of the fastest expanding polymer type segment in plastic waste management.

Source Insights

Why Did The Residential Segment Dominated The Plastic Waste Management Market In 2024?

The residential segment dominated the market in 2024. Waste generated from households continues to form a large part of the plastic waste mass, driven by packaging consumer goods and single use plastic items, which is why the residential source segment holds a dominant role. Because residential collection and recycling have become established and programmes are well developed in many regions, this source segment sustains the bulk of the market base.

The commercial and institutional segment is predicted to witness significant growth in market over the forecast period. Waste from commercial and institutional increasing regulatory and corporate sustainability scrutiny, pushing for improved collection, sorting and recycling in this domain. As business adopt sustainable packaging and waste management strategies, the commercial and institutional source category is positioned for accelerated growth the waste management market.

Sorting Technology Insights

Why Did The Optical/ NIR Based Segment Dominated The Plastic Waste Management Market In 2024?

The optical/ NIR based segment dominated the market in 2024. Optical and near-inferred (NIR) based automated sorting systems are coloured plastics, which sustains their dominance in sorting technology. Their broad deployment, reliability and established performance make them the cornerstone of current sorting infrastructure.

The AI/ robotics enhanced segment is anticipated to grow with the highest CAGR in the market during the studied years. The AI and robotics enhanced sorting technology segment is gaining traction as waste streams become more complex and contamination levels rise, integration of machine learning, vision systems and robotic arms enables higher accuracy, faster throughput and lower manual intervention. This technological upgrading positions the AI/robotics approach as the fastest growing sorting technology segment in the plastic waste management market.

End Use Industry

Why Did The Packaging And Bottles Segment Dominated The Plastic Waste Management Market In 2024?

The packaging and bottles segment dominated the market in 2024. Packaging and bottles remain the primary end use category for recycled plastics because they represent the largest volume of plastic waste generated and are targeted y many recycling policies and programs. The strong demand for recycled material in this sector underpins its dominant role in the waste management value chain.

The textiles and fibers segment is projected to experience the highest growth rate in the market between 2025 and 2034. The textiles and fibers segment is emerging as a growth frontier for recycled plastics, as consumer brands and apparel companies increasingly adopt recycled content for fabrics and industrial textiles; this opens new end use pathways for plastic waste streams beyond traditional packaging, creating fresh demand for opportunity in plastic waste management.

Regional Insights

Why Is Europe Dominating In The Plastic Waste Management Market?

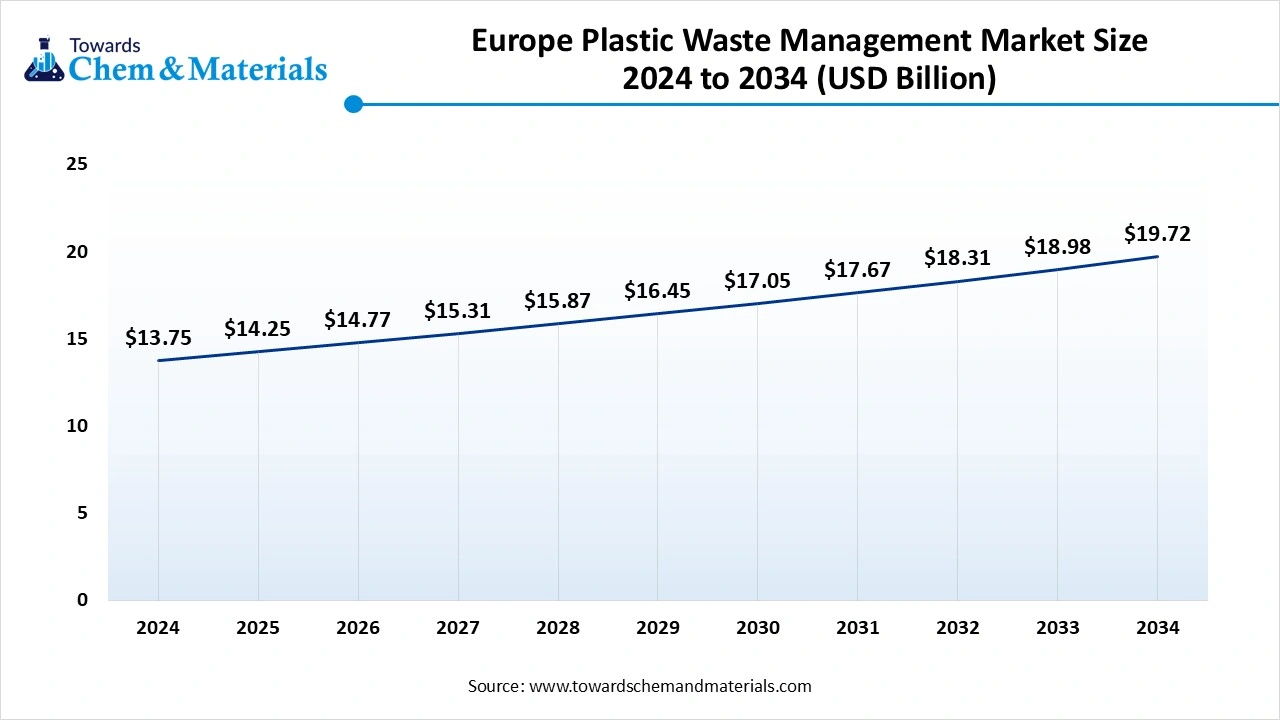

The Europe plastic waste management market size was valued at USD 13.75 billion in 2024 and is expected to reach USD 19.72 billion by 2034, growing at a CAGR of 3.67% from 2025 to 2034. Europe dominated the market with a share of 36% in 2024.

Europe dominated the market in 2024, the European region has emerged as the foremost hub for plastic waste management owing to a robust regulatory framework and a mature recycling infrastructure that emphasis the circular economy. The region’s dominance is driven by stringent policies around extended producer responsibility, high recycling targets and strong collection systems that divert plastic from landfills and oceans. Moreover, public awareness and eco conscious consumption patterns in Europe support higher columns of waste being channelled into formal management systems, reinforcing its leading position.

Within the border European market, the UK distinguishing itself with strong policy signals and growing private sector engagements to reducing single use plastics, improving recycle use in packaging and integrating waste management services are helping to elevate its role in the sector. These actions are supported by collaborations between waste service providers, brands and government bodies aimed at boosting transparency and traceability in the plastic waste value chain. As part of the Europe wide leadership in the market, the UK is therefore playing a strategic role in advancing processing technologies, collection systems and recycled content initiatives.

Why Is Asia Pacific Set To Surge In Plastic Waste Management?

The Asia Pacific region is becoming a major growth hotspot for plastic waste management thanks to rapidly increasing urbanisation and industrialization, which are driving up the generation of plastic waste and thus raising demand for effective waste management solutions. The expansion of mechanical and chemical recycling infrastructure, coupled with supportive government policies and private sector investments, is enabling the region to scale its collection, sorting and treatment capabilities. There is also a rising awareness of circular economy practices and stringer regulatory frameworks pushing for recycled content and extended producer responsibility, which are building momentum for the market.

North America Plastic Waste Management Market Trends

North America plastic waste management market is expected to grow at a consistent rate over the forecast period. Stringent environmental regulations characterize the plastic waste management market of North America. Moreover, the increasing consciousness regarding the impact of plastic waste on the environment among consumers, governments, and corporations is creating the need for plastic waste management. Similarly, innovations in waste management technologies, including advanced recycling and waste-to-energy solutions, are creating opportunities for market expansion. For instance, in April 2024, Canada's government announced an investment of over USD 3.3 million to support local organizations in combating plastic pollution, demonstrating its commitment to addressing plastic waste issues.

U.S. Plastic Waste Management Market Trends

The U.S. plastic waste management market accounted for the largest revenue share of the regional market in 2024. The market is significantly influenced by rules and mandates set by the state and federal governments, including policies such as the Extended Producer Responsibility (EPR) program. Additionally, the growing investment in waste management and recycling infrastructure presents a significant opportunity in the U.S. Significant investments are being made from both the public and private sectors to develop new technologies to tackle issues associated with plastic waste management.

Central & South America Plastic Waste Management Market Trends

Central & South America plastic waste management market is expected to witness significant growth owing to the need for sustainable waste management solutions. The expansion of urban areas has led to increased plastic waste production, necessitating plastic waste management and recycling. The plastic waste management market of Brazil is projected to grow at a considerable CAGR over the forecast period, owing to stringent government regulations and resource conservation. The National Policy for Solid Waste Treatment and increasing public-private partnerships in waste management act as market drivers for plastic waste management in the country.

Middle East & Africa Plastic Waste Management Market Trends

The Middle East and Africa plastic waste management market is driven by the increase in industrial activities, expanding populations, and growth in urbanization. Increasing environmental consciousness and strict rules focused on reducing waste and safeguarding the environment fuel the need to manage plastic waste.

Plastic Waste Management Market Top Companies

- Remondis: Provides large-scale recycling and waste management services across 30+ countries, converting plastic waste into reusable materials.

- Biffa: Operates recycling plants in the UK, processing PET and HDPE into high-purity pellets for food-grade applications.

- Indorama Ventures: Expanding PET recycling capacity globally, producing recycled resins to reduce virgin plastic dependency.

- LyondellBasell: Developing chemical recycling facilities to convert plastic waste into raw materials, supporting circular economy goals.

- Eastman: Uses advanced recycling technologies to transform plastic waste into new materials.

- Tomra: Provides sensor-based sorting and reverse vending systems for efficient plastic collection.

- ALPLA: Specializes in mechanical recycling and closed-loop packaging solutions.

- Plastipak: Focuses on sustainable packaging production using recycled plastics.

- KW Plastics: Produces high-quality recycled HDPE and PP resins at large scale.

- MBA Polymers: Recovers plastics from electronics and automotive waste, reducing landfill dependency.

More Insights in Towards Chemical and Materials:

- Sustainable Plastics Market ; The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- Polymers Market : The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Plastic Lidding Films Market : The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034.

- Recycled Engineering Plastics Market : The global recycled engineering plastics market size was valued at USD 4.85 billion in 2024 and is expected to hit around USD 7.89 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% over the forecast period from 2025 to 2034.

- Asia Pacific Recycled Plastics Market : The Asia Pacific recycled plastics market stands at 40.33 million tons in 2025 and is forecast to reach 81.91 million tons by 2034, expanding at a CAGR of 8.19% from 2025 to 2034.

- Mechanical Recycling of Plastics Market ; The global Mechanical Recycling Of Plastics Market is expected to reach a volume of approximately 54.87 million tons in 2025, with a forecasted increase to 120.26 million tons by 2034, growing at a CAGR of 9.11% from 2025 to 2034.

- Recycled Plastic Pipes Market : The global recycled plastic pipes market size was approximately USD 7.85 billion in 2024 and is projected to reach around USD 20.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.85% between 2025 and 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market ; The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Plastic Hot and Cold Pipe Market : The global plastic hot and cold pipe-market size was valued at USD 7.85 billion in 2024, grew to USD 8.37 billion in 2025, and is expected to hit around USD 14.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.64% over the forecast period from 2025 to 2034.

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Plastic Injection Molding Market : The global plastic injection molding market volume is approximately 155.64 million tons in 2025 and is forecast to reach 227.73 million tons by 2034, growing at a CAGR of 4.32% from 2025 to 2034.

- Corrugated Plastic Sheets Market : The global corrugated plastic sheets market size was valued at USD 1.85 billion in 2024, grew to USD 1.95 billion in 2025, and is expected to hit around USD 3.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.14% over the forecast period from 2025 to 2034.

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Microplastic Recycling Market : The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034.

- Plastic Compounding Market : The global plastic compounding market size was reached at USD 72.55 billion in 2024 and is expected to be worth around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- U.S. Biodegradable Plastics Market : The U.S. biodegradable plastics market size is calculated at USD 2.14 billion in 2024, grew to USD 2.34 billion in 2025, and is projected to reach around USD 5.27 billion by 2034. The market is expanding at a CAGR of 9.44% between 2025 and 2034.

- U.S. Smart Plastics In Precision Agriculture Market : The U.S. smart plastics in precision agriculture-market size was valued at USD 485.19 million in 2024, grew to USD 539.29 million in 2025, and is expected to hit around USD 1,396.39 million by 2034, growing at a compound annual growth rate (CAGR) of 11.15% over the forecast period from 2025 to 2034.

- U.S. Plastic Lidding Films Market : The U.S. plastic lidding films market size was valued at USD 711.19 million in 2024, grew to USD 741.42 million in 2025, and is expected to hit around USD 1,078.32 million by 2034, growing at a compound annual growth rate (CAGR) of 4.25% over the forecast period from 2025 to 2034.

- U.S. Plastics Market ; The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics Market : The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034.

- Asia Pacific Plastic Compounding Market : The Asia Pacific plastic compounding market size was reached at USD 33.85 billion in 2024 and is expected to be worth around USD 77.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.65% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Asia Pacific Recycled Plastics Market : The Asia Pacific recycled plastics market stands at 40.33 million tons in 2025 and is forecast to reach 81.91 million tons by 2034, expanding at a CAGR of 8.19% from 2025 to 2034.

-

U.S. Plastic Compounding Market : The U.S. plastic compounding market size was reached at USD 11.19 billion in 2024 and is expected to be worth around USD 22.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

Plastic Waste Management Market Top Key Companies:

- Remondis

- Biffa

- Indorama Ventures

- LyondellBasell

- Eastman

- Tomra

- ALPLA

- Plastipak

- KW Plastics

- MBA Polymers

Recent Developments

- In June 2025, A coalition of development banks announced an investment of several billion euros to ramp up efforts against ocean bound plastic pollution, signaling increasing financial commitment to large scale collection and recovery programs.

- In June 2025, researchers in Japan revealed a new kind of plastic that dissolves in seawater within hours, offering a potentially transformative material solution to marine pollution and challenging current end of life plastics approaches.

Plastic Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Plastic Waste Management Market

By Service Type

- Collection & Transportation

- Sorting & MRF Operations

- Mechanical Recycling

- Chemical Recycling (Advanced)

- Energy Recovery (WtE)

- Landfilling / Disposal

By Treatment Method

- Mechanical Recycling

- Chemical Recycling

- Energy Recovery (Incineration/WtE)

- Landfilling

By Polymer Type

- Polyethylene (PE)

- HDPE

- LDPE/LLDPE

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Others (ABS, PA, PC, etc.)

By Source

- Residential

- Commercial & Institutional

- Industrial

- Agriculture & Construction

By Sorting Technology

- Manual & Basic Mechanical

- Optical / NIR-Based Automated Sorting

- AI / Robotics-Enhanced Sorting

- Density & Electrostatic Separation

By End Use of Recovered Plastics

- Packaging & Bottles

- Textiles & Fibers

- Construction Products (Pipes, Lumber, Panels)

- Automotive & E&E

- Consumer Goods / Housewares

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5925

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.